Shopify tax calculation

The Utah sales tax rate is currently. The average cumulative sales tax rate in Salt Lake City Utah is 76.

Shopify Calculating California Sales Tax Incorrectly Shopify Community

No cities in the Beehive.

. States set a rate and then localities can add a percentage on top of those rates. Lets plan your success. Ad Find out what tax credits you qualify for and other tax savings opportunities.

Ad Maximize your potential and grow your business with unlimited capital aligned to your plan. Hello Can you please update on which base tax is calculated within accountings in a state. Ad Maximize your potential and grow your business with unlimited capital aligned to your plan.

Keep more profit while reducing risk and stress. A note on sales tax rates. Salt Lake City is located within Salt Lake County Utah.

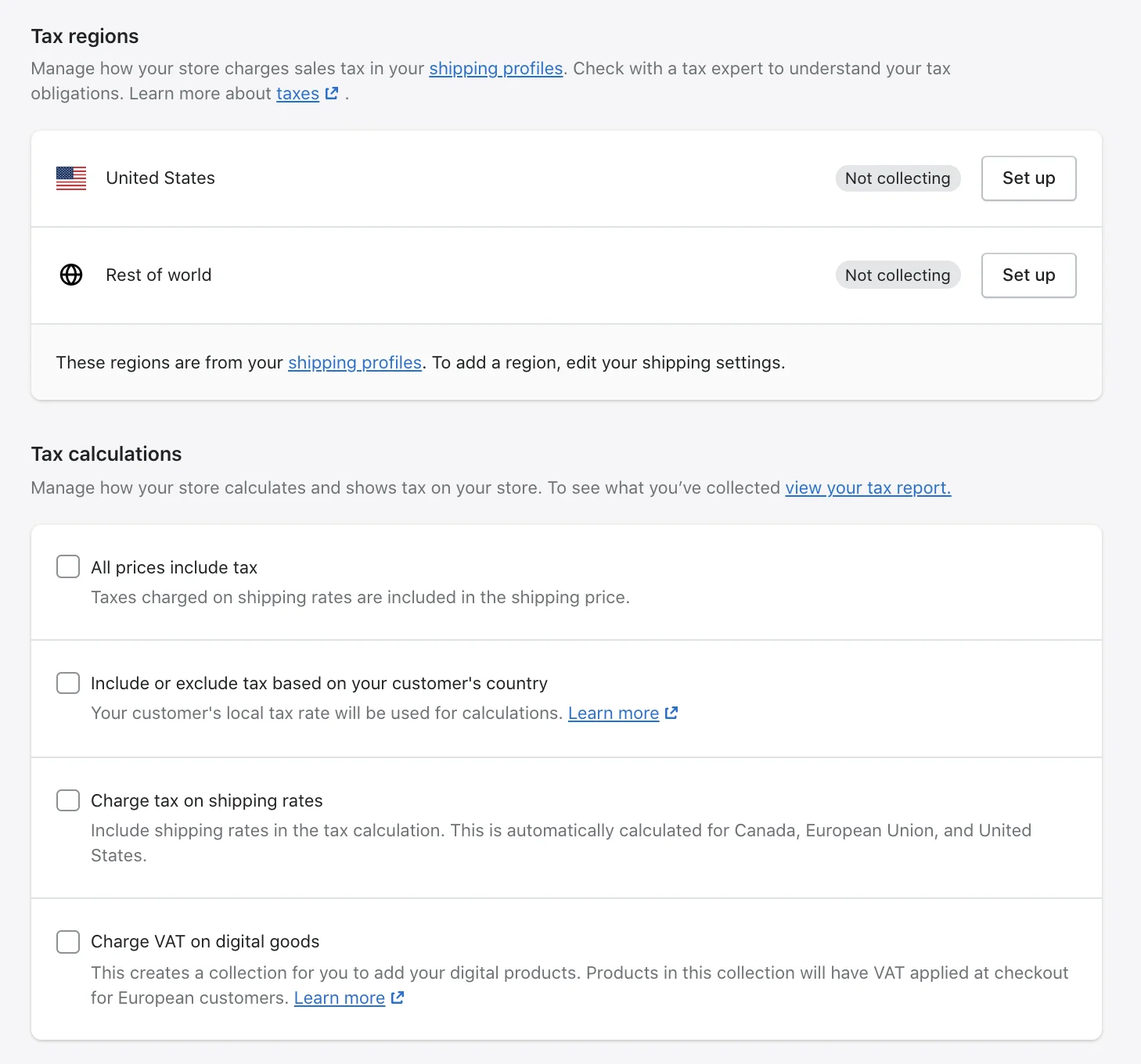

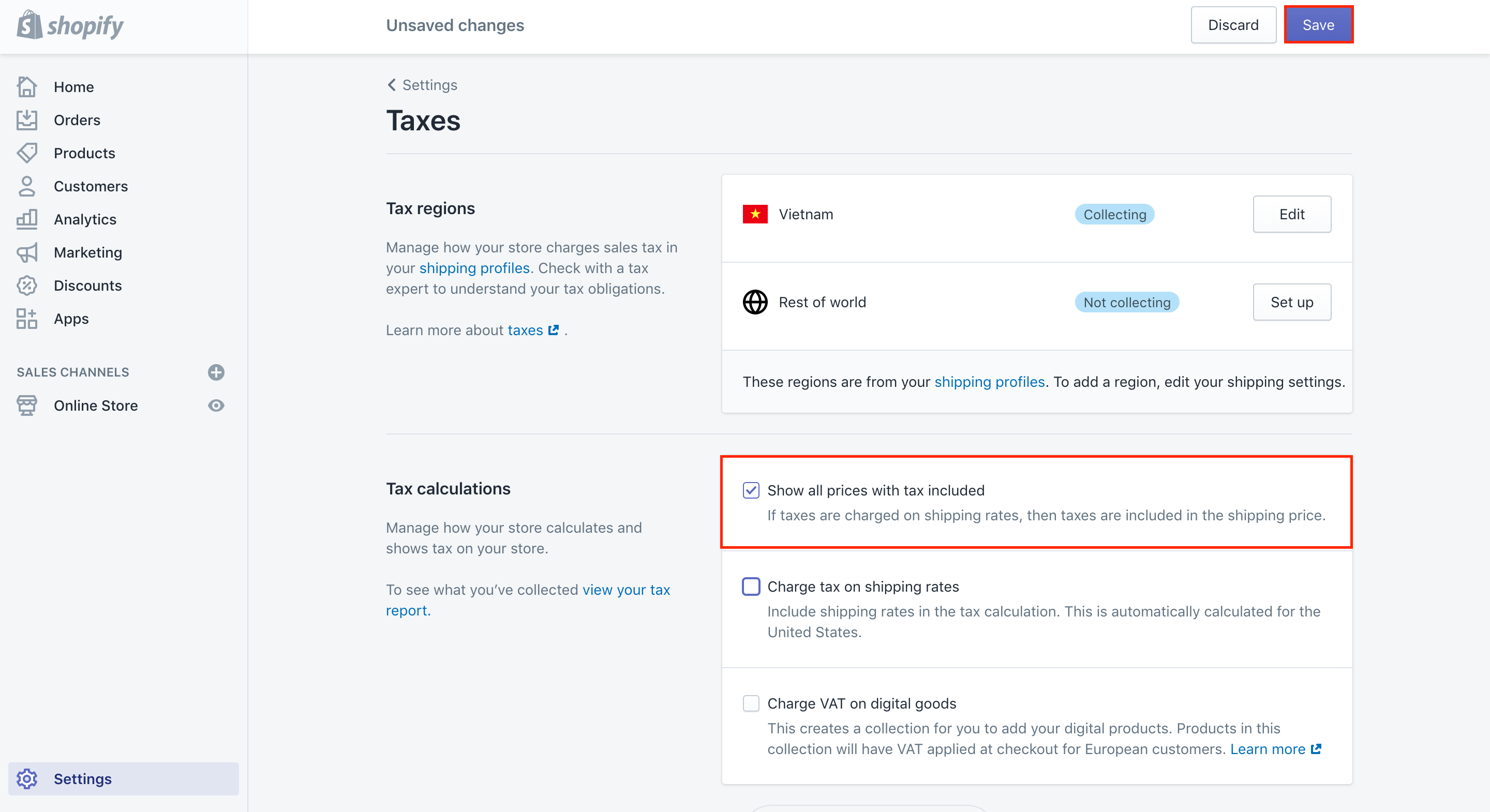

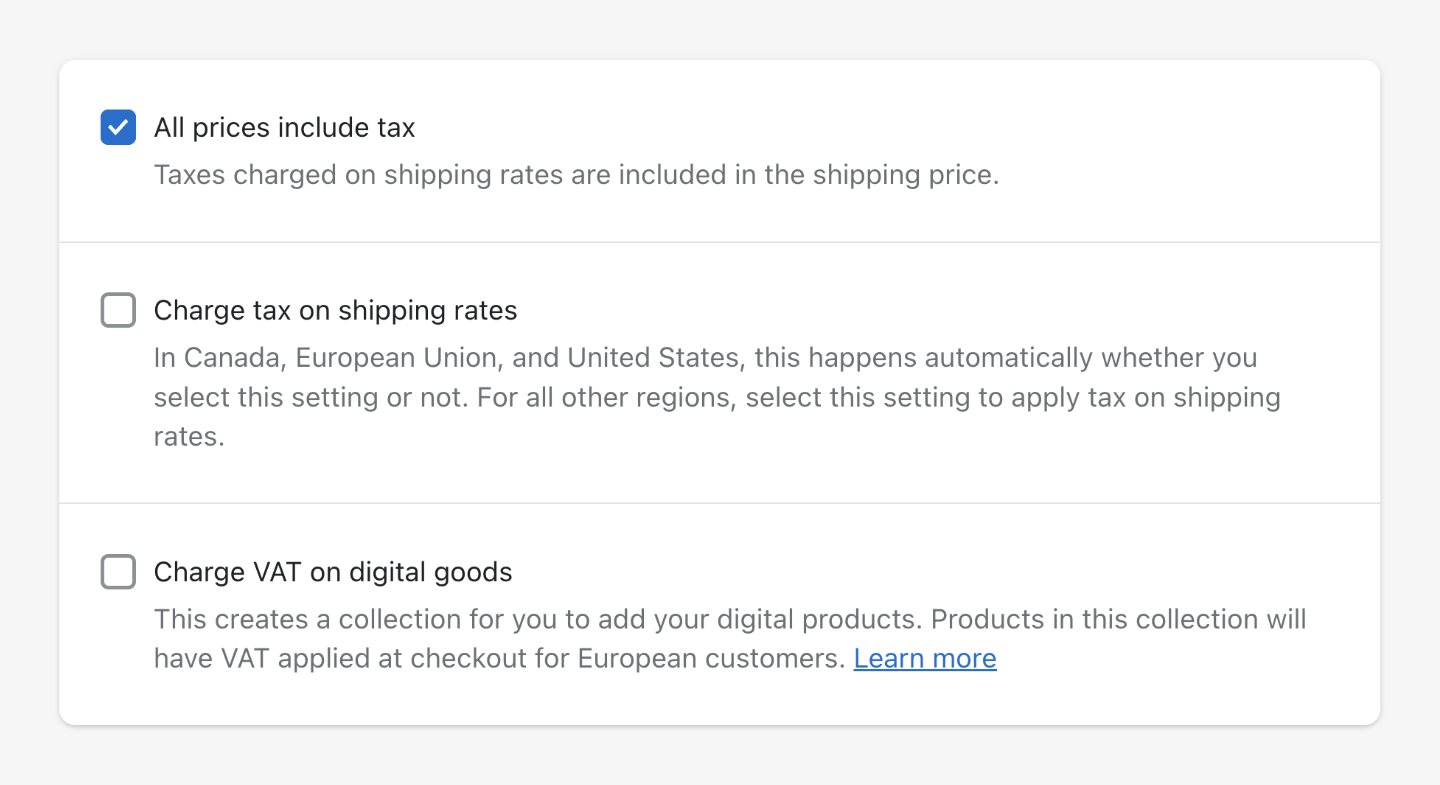

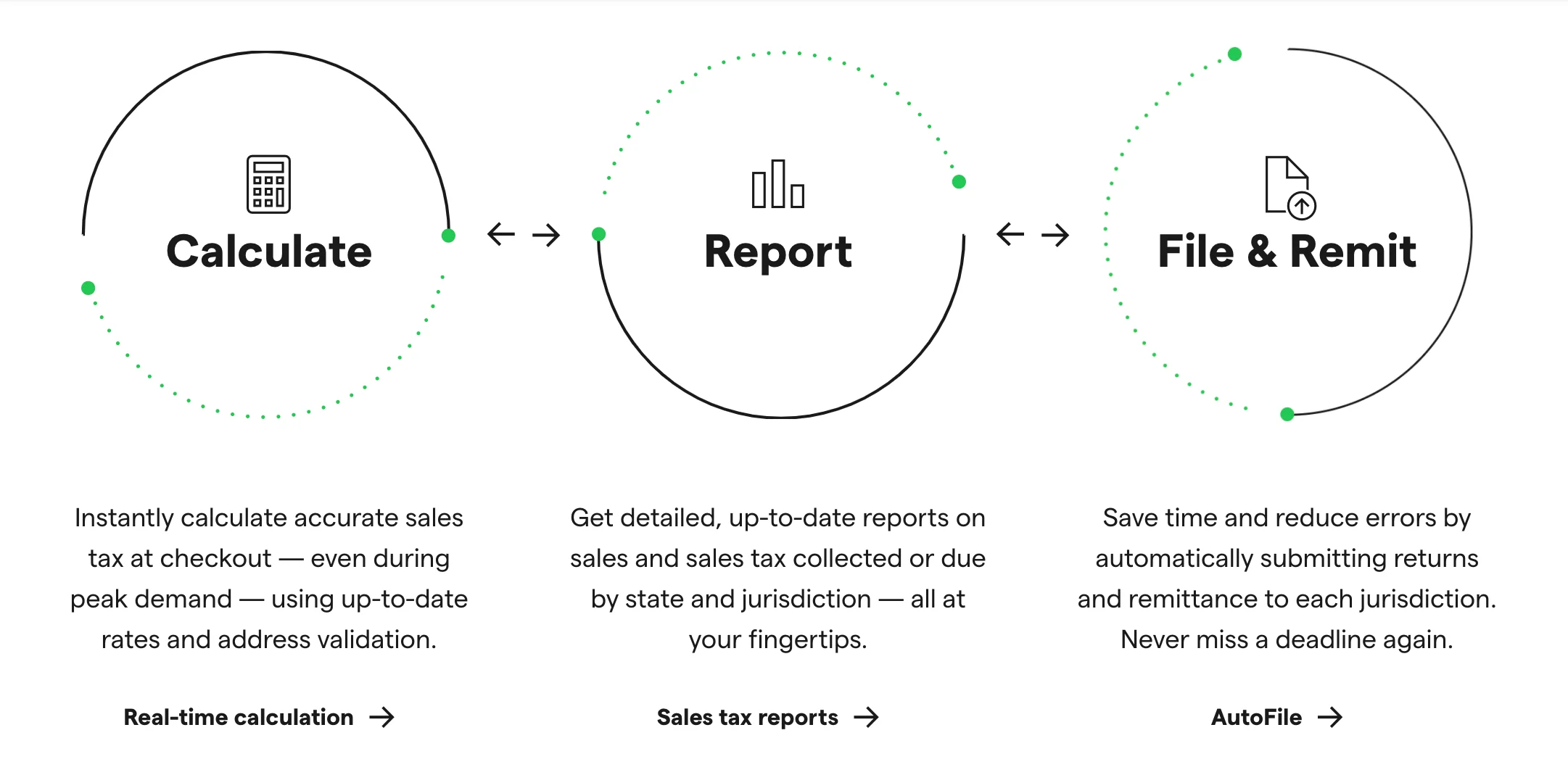

Quaderno automatically calculates the correct tax rate on every transaction based on the data provided by Shopify and issues a receipt for. After youve determined where you need to charge tax in the United States you can set your Shopify store to automatically manage the tax rates used to calculate sales on taxes and set. 050 Rohnert Park City.

So we are registered in California and if we shipped to different states in California. Utah has a very simple income tax system with just a single flat rate. Ad Find out what tax credits you qualify for and other tax savings opportunities.

Lets plan your success. I currently have the auto tax calculator. Stores shipping to Canada the default tax rate is 0 whereas for Canadian stores the default federal tax rate for Canada is 5.

The minimum combined 2022 sales tax rate for Salt Lake City Utah is. Sales tax is calculated by multiplying the purchase price by the. This includes the rates on the state county city and special levels.

Get a personalized recommendation tailored to your state and industry. Calculate the correct tax rate on every transaction. Get a personalized recommendation tailored to your state and industry.

All taxpayers in Utah pay a 495 state income tax rate regardless of filing status or income tier. For example in the 90210 zip code the tax rate is the 65. The County sales tax rate.

You can find the rates under. The Sales Tax charged should have been. This is the total of state county and city sales tax rates.

Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. Keep more profit while reducing risk and stress. For example for US.

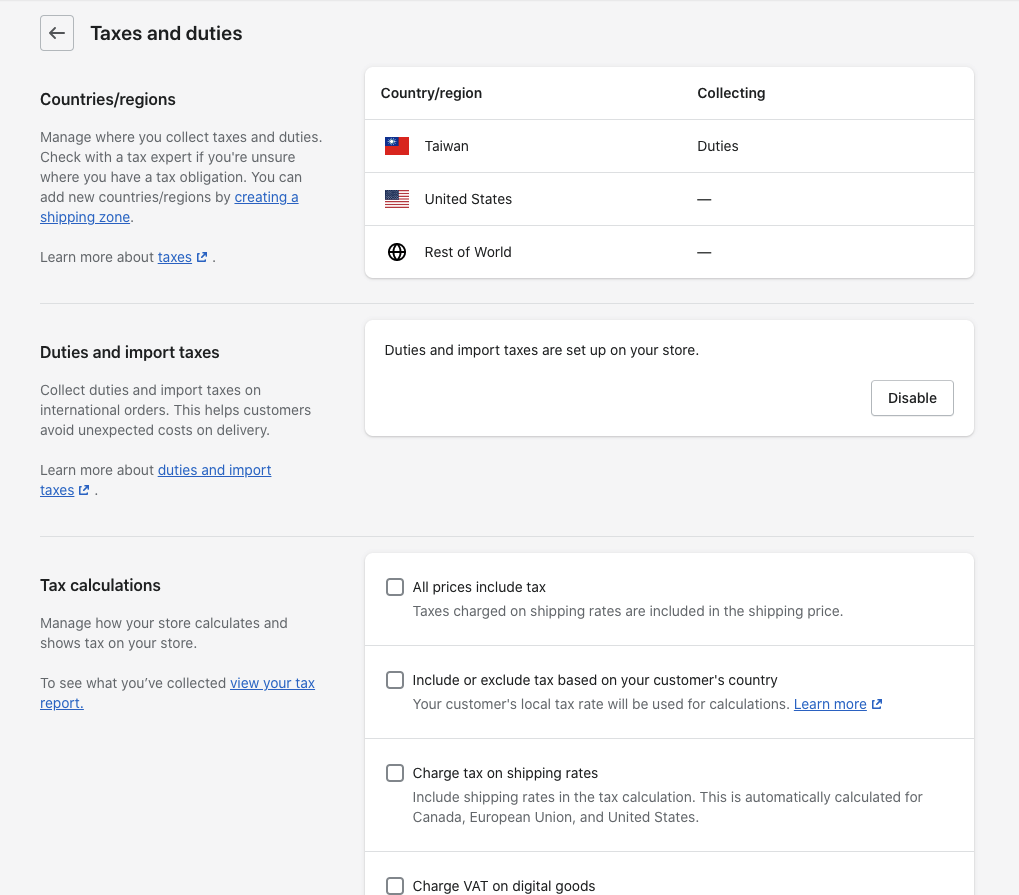

Shopify Duties And Taxes Support Shopify Markets Easyship Support

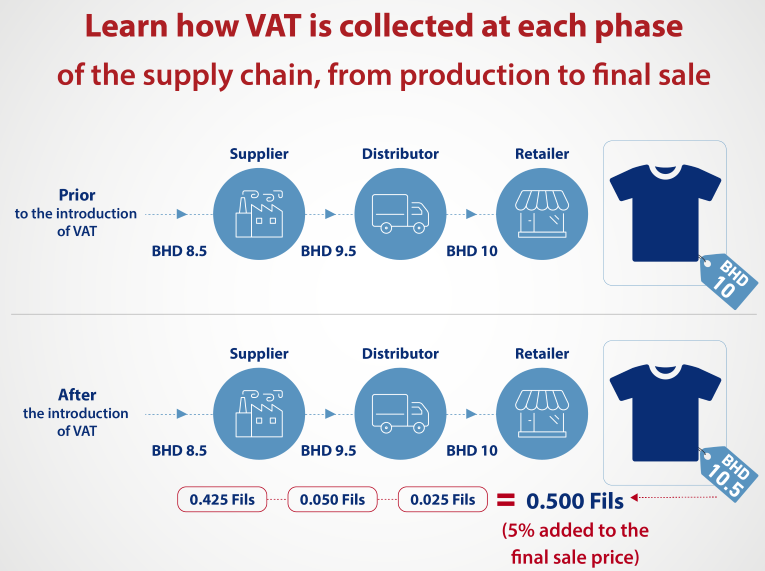

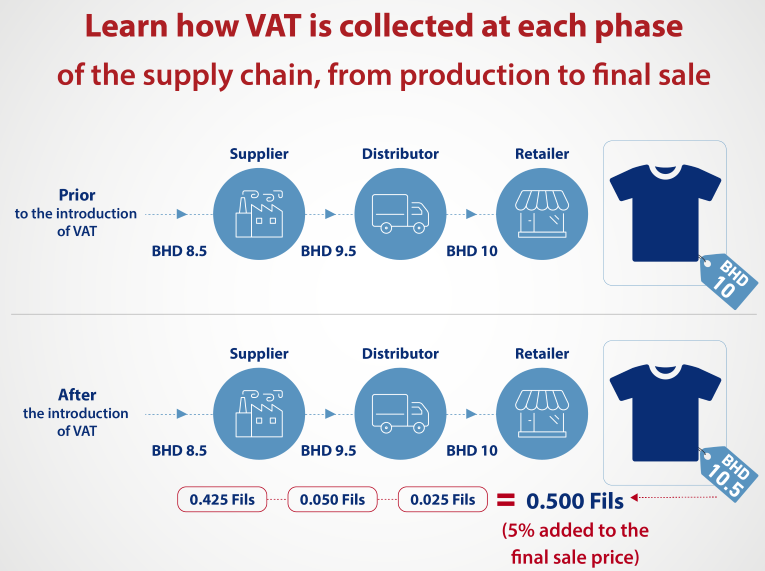

Tax Calculation For Online Dealers On The Shopify Platform In Europe

Shopify Apps For Taxes Simple Guide To Taxes On Shopify

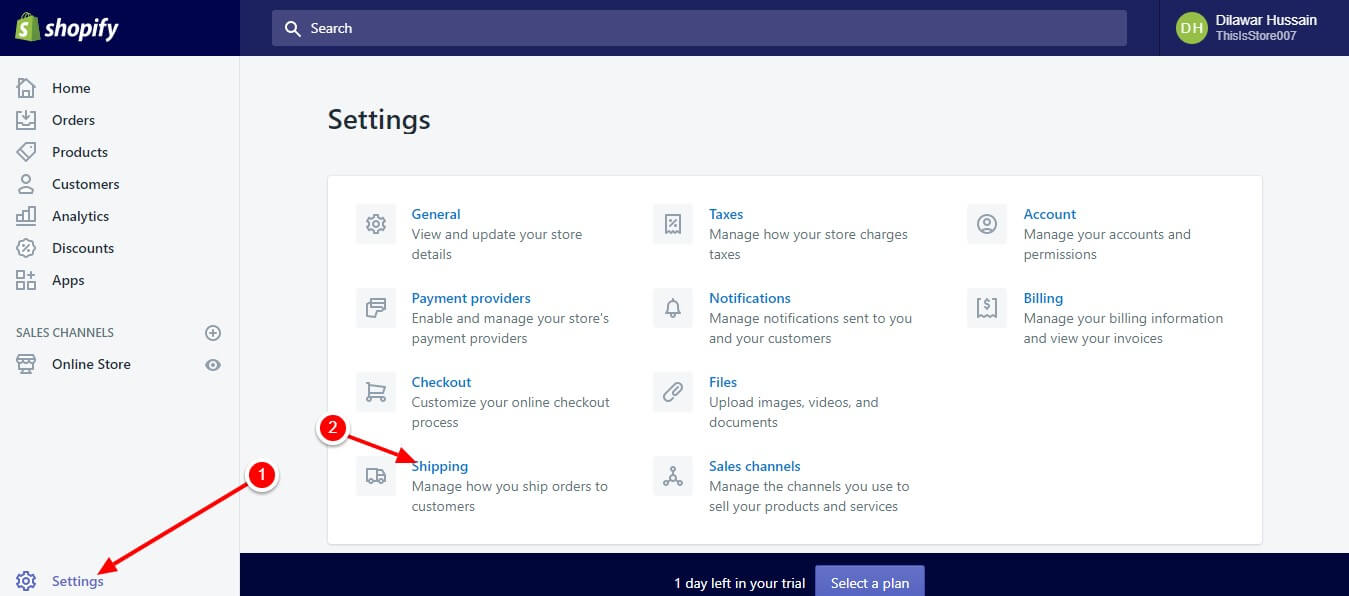

Pin On Shopify

How To Charge Shopify Sales Tax On Your Store Sep 2022

Shopify S Sales Tax Liability And Nexus Dashboard Results Explained Taxvalet

What Is The Formula For Tax Calculation On Shopify Orders Shopify Community

Rich And User Friendly Features Of Opencart Ecommerce Website Development Opencart Ecommerce

Re Different Taxes On Shipping Shopify Community

How To Charge Shopify Sales Tax On Your Store Sep 2022

How To Use An Excel Spreadsheet Excel Spreadsheets Excel Spreadsheets Templates Spreadsheet Template

Shopify Calculating California Sales Tax Incorrectly Shopify Community

Rule Of 69 Meaning Benefits Limitations And More Financial Life Hacks Learn Accounting Accounting Basics

How To Charge Taxes On Shopify Store

Include Or Exclude Tax From Product Prices In Shopify Sufio For Shopify

How To Charge Shopify Sales Tax On Your Store Sep 2022

How To Charge Shopify Sales Tax On Your Store Sep 2022